Understanding Biblical Budgeting

Biblical budgeting is a financial management approach that aligns personal finances with the teachings and values found in Scripture. It emphasizes the principles of stewardship, which refers to the responsible management of the resources entrusted to individuals by God. In the life of a believer, budgeting transcends the mere act of tracking expenses and income; it becomes a spiritual exercise that reflects one’s faith and priorities. By understanding biblical budgeting, Christians can develop a framework that not only supports their financial goals but also honors their beliefs.

At its core, biblical budgeting encourages individuals to view their financial decisions through the lens of their faith. This perspective shifts the mindset from viewing budgeting as a restrictive task to seeing it as a liberating practice that promotes financial freedom. By adhering to biblical principles, believers can ensure that their financial activities are not in conflict with their spiritual values. This alignment fosters a sense of peace, allowing for better decision-making that contributes to overall stability and prosperity.

Moreover, biblical budgeting invites individuals to contemplate their deeper purpose regarding money. It encourages reflection on how resources can be utilized to support not only personal goals but also the needs of the community and the greater mission of the Church. Terminologies such as tithing, generosity, and giving infiltrate the conversation around budgeting, instilling a culture of abundance rather than scarcity. With a focus on stewardship, budgeting becomes a meaningful activity that integrates faith with actionable financial strategies. In essence, when believers practice biblical budgeting, they are not just managing their resources but actively participating in God’s work on Earth.

The 7 Principles of Biblical Budgeting

Biblical budgeting is a vital component of financial stewardship, grounded in key scriptural principles that offer profound guidance. Here, we outline the seven essential principles derived from Scripture, supporting individuals in managing their financial resources effectively while honoring God.

1. Ownership: The foundation of biblical budgeting acknowledges that everything belongs to God. Psalm 24:1 affirms, “The earth is the Lord’s, and everything in it.” Understanding this principle fosters gratitude and mindful spending, as individuals manage resources on behalf of the true Owner.

2. Stewardship: Following the first principle, stewardship emphasizes responsible management of God’s resources. In Luke 16:10-11, we are reminded that faithfulness in small matters can lead to greater responsibilities. Creating a budget serves as a practical tool to track expenses and prioritize spending in alignment with God’s teachings.

3. Income and Giving: A key aspect of biblical budgeting involves recognizing the importance of both income and giving. 2 Corinthians 9:7 encourages cheerful giving, suggesting that a portion of every income should be set aside for charitable purposes. Including generosity in budgeting not only benefits others but also strengthens one’s spiritual journey.

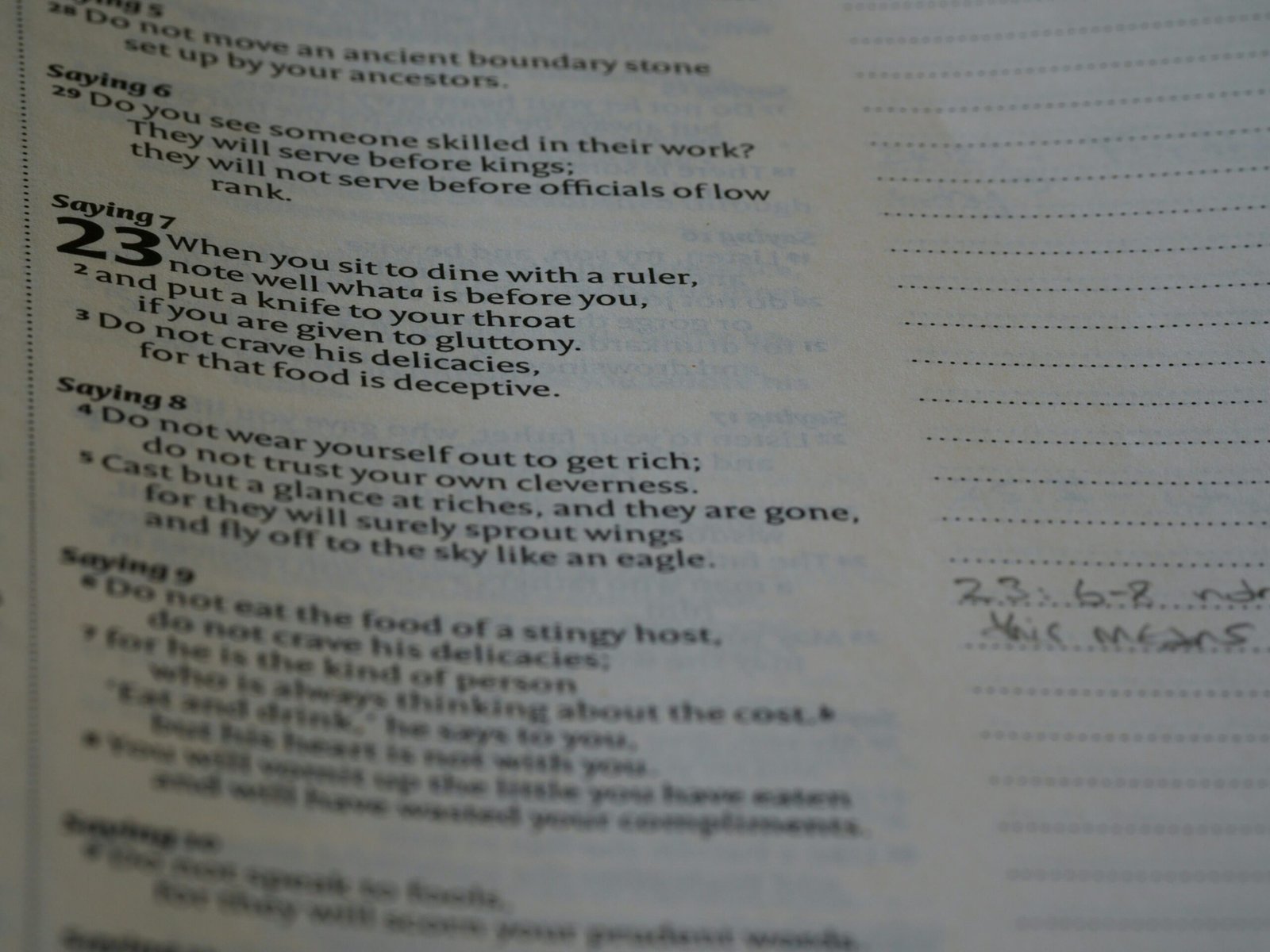

4. Planning: Proverbs 21:5 states, “The plans of the diligent lead surely to abundance.” Effective budgeting necessitates planning and foresight. Individuals should assess their total income and expenses, allowing them to set realistic financial goals and make informed decisions about their resources.

5. Avoidance of Debt: Scripture advises against unnecessary debt, as seen in Proverbs 22:7 which highlights that “The borrower is the slave of the lender.” A biblical budget should ideally aim to minimize debt by promoting wise spending choices and prioritizing financial freedom.

6. Contentment: Philippians 4:11-12 teaches the value of contentment, regardless of financial circumstances. A budget rooted in this principle helps individuals distinguish between needs and wants, leading to more prudent decisions and reduced financial stress.

7. Accountability: Finally, accountability is crucial in biblical budgeting. Proverbs 27:17 illustrates that “Iron sharpens iron,” suggesting that forming support groups can provide encouragement and guidance. Keeping one’s budget transparent to a trusted individual can enhance commitment to financial goals and principles.

By implementing these seven principles of biblical budgeting, individuals can transform their financial practices into a fulfilling endeavor that glorifies God and fosters personal growth.

Practical Steps to Implement a Biblical Budget

Implementing a biblical budget requires intentionality and a commitment to aligning financial habits with scriptural principles. Here are some actionable steps to help you create a faith-based budget that reflects your values and priorities.

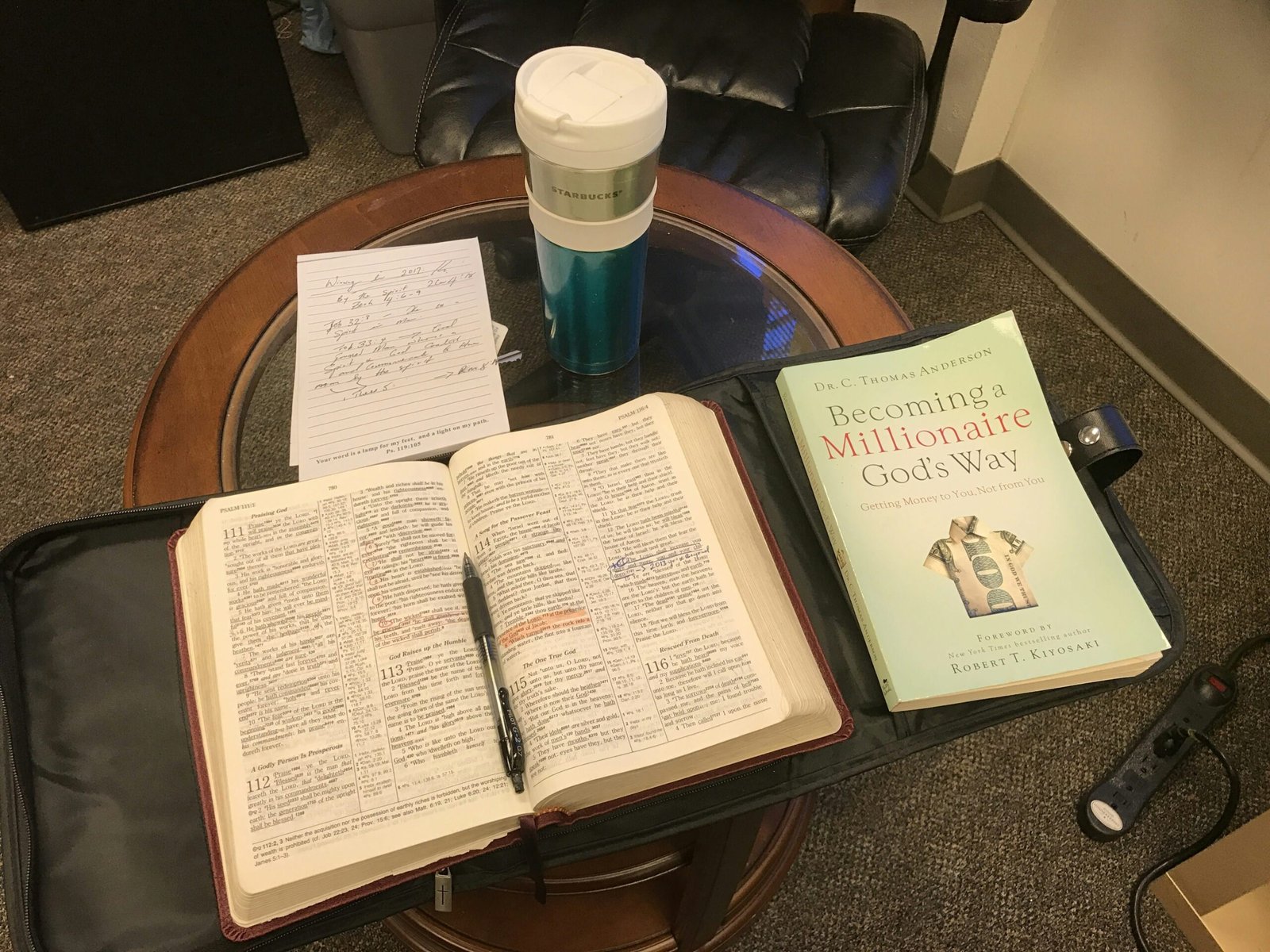

Begin by tracking your spending meticulously. Document every expense for at least a month to gain insight into where your money goes. This exercise will highlight patterns and habits, helping to identify areas where adjustments can be made. Utilize budgeting apps or simple spreadsheets to facilitate this process, ensuring that you can review and analyze your financial behavior conveniently.

Next, set clear financial goals. Consider both short-term and long-term objectives, such as saving for emergencies, paying off debt, or giving to charitable causes. Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals can provide direction and motivation in your financial planning. Align these objectives with biblical values, focusing on stewardship and generosity as integral components of your financial journey.

Prioritization is crucial when creating a budget. Distinguish between needs and wants to allocate resources effectively. Essential expenses such as housing, food, and healthcare should take precedence over discretionary spending on entertainment or luxury items. This prioritization fosters a mindset of contentment and gratitude, reflecting biblical teachings on the importance of managing resources wisely.

Finally, incorporate prayer and spiritual reflection into the budgeting process. Seek God’s guidance in financial decision-making and ask for wisdom in aligning your budget with your faith. Engaging in regular prayer regarding your finances not only invites divine assistance but also cultivates a deeper understanding of biblical principles related to money management.

By following these practical steps, you can create and implement a biblical budget that aligns with your values, supports your financial objectives, and enhances your spiritual journey.

Overcoming Challenges in Biblical Budgeting

Implementing a biblical budget often presents various challenges that individuals may not initially anticipate. The first significant hurdle is managing unexpected expenses. Life is inherently unpredictable, and unplanned costs such as medical bills, car repairs, or home maintenance can disrupt a carefully crafted budget. To overcome this challenge, it is advisable to create a contingency fund specifically for unforeseen expenses. This fund allows individuals to handle emergencies without derailing their entire financial plan, thus providing peace of mind and maintaining the integrity of their biblical budgeting.

Another common challenge is sustaining motivation over time. Initial enthusiasm for budget adherence can wane, especially once the initial excitement diminishes. To combat potential complacency, it is crucial to establish clear, achievable goals that align with biblical principles. Regularly reviewing these goals and celebrating small victories can reinvigorate one’s commitment to adhere to the budget. Moreover, finding accountability partners within the faith community can provide both encouragement and motivation to persist with budgeting efforts.

Feelings of guilt or pressure related to financial decisions may also arise, especially when others appear to have more financial freedom or when confronted with cultural norms around spending. It is essential to remember that biblical budgeting is about fostering a lifestyle that aligns with one’s faith rather than adhering to societal expectations. Engaging in regular prayer and reflection can help to alleviate guilt, allowing individuals to focus on gratitude and stewardship instead. By embracing the principles of simplicity and contentment, individuals can navigate the emotional aspects of budgeting with confidence.

Staying rooted in one’s faith provides the strength to overcome these obstacles and encourages persistence in pursuing financial stewardship as taught in Scripture. With thoughtful strategies and a strong support system, individuals can successfully navigate the challenges of biblical budgeting while remaining true to their spiritual commitments.